Never bet against America--Warren Buffett

![chargingbull-1024x816[1].jpg](https://static.wixstatic.com/media/af7e64_00e621149b2c4f4dab6dc1fff0381e4f~mv2.jpg/v1/fill/w_859,h_680,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/chargingbull-1024x816%5B1%5D.jpg)

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index that measures the stock performance of 30 large companies listed on stock exchanges in the United States. Although it is one of the most commonly followed equity indices, many consider the Dow to be an inadequate representation of the overall U.S. stock market compared to broader market indices such as the S&P 500 Index or Russell 3000 because it only includes 30 large cap companies, is not weighted by market capitalization, and does not use a weighted arithmetic mean.

The value of the index is the sum of the stock prices of the companies included in the index, divided by a factor which is currently (as of June 2020[update]) approximately 0.1458. The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split.

First calculated on May 26, 1896, the index is the second-oldest among the U.S. market indices (after the Dow Jones Transportation Average). It was created by Charles Dow, the editor of The Wall Street Journal and the co-founder of Dow Jones & Company, and named after him and his business associate, statistician Edward Jones. The word industrial in the name of the index no longer reflects its composition: several of the constituent companies operate in sectors of the economy other than heavy industry.

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee. The ten components with the largest dividend yields are commonly referred to as the Dogs of the Dow. As with all stock prices, the prices of the constituent stocks and consequently the value of the index itself are affected by the performance of the respective companies as well as macroeconomic factors.

Components

As of August 31, 2020, the Dow Jones Industrial Average consists of the following companies:

Annual income

The following table shows the annual return of the Dow Jones Index for nearly 50 years.

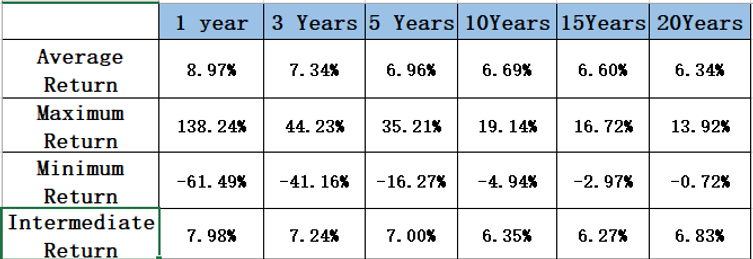

DJIA historical return results

S&P 500

S&P 500, abbreviated as S&P, is a stock market index used to measure the stock performance of 500 large companies listed on the American Stock Exchange. It is one of the most commonly used stock indexes, and many people consider it to be one of the best representatives of the US stock market. Since its establishment in 1926, the average annual total return of the index, including dividends, has been 9.8%. However, the index has fallen by more than 30% for several years. The index grows every year during 70% of the time. For a list of index components, see the S&P 500 company list. The component that has increased dividends for 25 consecutive years is called the S&P 500 dividend aristocracy. The Standard & Poor's 500 Index is a capital-weighted index. The top 10 companies in the index account for 21.8% of the index's performance.

Warren Buffett, Burton Malkiel, and John C. Bogle have recommended funds that track the index as long-term investors.Although the index only includes companies listed in the United States, it may include non-US companies in the future. It already includes many multinational companies; the companies in the index receive only 71% of their revenue in the United States on average.The index is one of the factors used to calculate the leading economic index of the board of directors and is used to predict the direction of economic development.

The index is associated with many stock symbols, including: ^GSPC, INX, and $SPX, depending on the market or website. The index value is updated every 15 seconds, that is, 1,559 times per trading day, and Reuters publishes price updates.The S&P 500 Index is maintained by S&P Dow Jones Indices, which is a majority stake in S&P Global and its components are selected by the committee.The easiest way to invest in the S&P 500 index is to buy an index fund, a mutual fund or exchange traded fund, which can replicate the performance of the index by holding the same stocks as the index without deducting fees and expenses. The same ratio. Exchange-traded funds (ETFs) that replicate the performance of the index are issued by The Vanguard Group (NYSE Arca: VOO), iShares (NYSE Arca: IVV) and State Street Corporation (NYSE Arca: SPY). These can be purchased through any stockbroker, sometimes without commission. In addition, the mutual funds that track the index include Fidelity Investments, Provided by several publishers including Rowe Price and Charles Schwab.

Derivatives

In the derivatives market, the Chicago Mercantile Exchange (CME) offers futures contracts that track the index and trade on the exchange floor in an open outcry auction, or on CME's Globex platform, and are the exchange's most popular product. Ticker symbols are /SP for the full-sized contract and /ES for the E-mini S&P contract that is one fifth the size of /SP. In May 2019, the CME started trading a Micro E-mini futures contract that is one tenth the size of the S&P E-mini contract, i.e. 1/50 the size of the full-sized (SP) contract. The Micro E-mini S&P 500 Index contract's ticker symbol is /MES.

The Chicago Board Options Exchange (CBOE) offers options on the S&P 500 index as well as on S&P 500 index ETFs, inverse ETFs, and leveraged ETFs.

History

In 1860, Henry Varnum Poor formed Poor's Publishing, which published an investor's guide to the railroad industry.

In 1923, Standard Statistics Company (founded in 1906 as the Standard Statistics Bureau) began rating mortgage bonds and developed its first stock market index consisting of the stocks of 233 U.S. companies, computed weekly.

In 1926, it developed a 90-stock index, computed daily.

In 1941, Poor's Publishing merged with Standard Statistics Company to form Standard & Poor's.

On March 4, 1957, the index was expanded to its current 500 companies and was renamed the S&P 500 Stock Composite Index.

In 1962, Ultronic Systems became the compiler of the S&P indices including the S&P 500 Stock Composite Index, the 425 Stock Industrial Index, the 50 Stock Utility Index, and the 25 Stock Rail Index.

On August 31, 1976, The Vanguard Group offered the first mutual fund to retail investors that tracked the index.

On April 21, 1982, the Chicago Mercantile Exchange began trading futures based on the index.

On July 1, 1983, Chicago Board Options Exchange began trading options based on the index.

On January 22, 1993, the Standard & Poor’s Depositary Receipts exchange-traded fund issued by State Street Corporation began trading.

On September 9, 1997, CME Group introduced the S&P E-mini futures contract.

In 2005, the index transitioned to a public float-adjusted capitalization-weighting.

Selection criteria

Like other indices managed by S&P Dow Jones Indices, but unlike indices such as the Russell 1000 which are strictly rule-based, the components of the S&P 500 index are selected by a committee. When considering the eligibility of a new addition, the committee assesses the company's merit using eight primary criteria: market capitalization, liquidity, domicile, public float, Global Industry Classification Standard and representation of the industries in the economy of the United States, financial viability, length of time publicly traded, and stock exchange.

Requirements to be added to the index include:

-

Market capitalization must be greater than or equal to US$8.2 billion

-

Annual dollar value traded to float-adjusted market capitalization is greater than 1.0

-

Minimum monthly trading volume of 250,000 shares in each of the six months leading up to the evaluation date

-

Must be publicly listed on either the New York Stock Exchange (including NYSE Arca or NYSE American) or NASDAQ (NASDAQ Global Select Market, NASDAQ Select Market or the NASDAQ Capital Market).

Securities that are ineligible for inclusion in the index are limited partnerships, master limited partnerships and their investment trust units, OTC Bulletin Board issues, closed-end funds, exchange-traded funds, Exchange-traded notes, royalty trusts, tracking stocks, preferred stock, unit trusts, equity warrants, convertible bonds, investment trusts, American depositary receipts, and American depositary shares.

To remain indicative of the largest public companies in the United States, the index is reconstituted quarterly; however, efforts are made to minimize turnover in the index as a result of declines in value of constituent companies.

A stock may rise in value when it is added to the index since index funds must purchase that stock to continue tracking the index.

Performance

On August 12, 1982, the index closed at 102.42.

On Black Monday (1987), the index realized its worst daily percentage loss, falling 20.47% in a single day.

In October 1996, the index closed above 700.

On February 12, 1997, the index closed above 800 for the first time.

On February 2, 1998, the index closed above 1,000 for the first time.

On March 24, 2000, at the peak of the dot-com bubble, the index reached an intraday high of 1,552.87; this high was not exceeded until May 30, 2007. On October 10, 2002, during the stock market downturn of 2002, the index fell to 768.83, a decline of approximately 50% from its high in March 2000.

On May 30, 2007, the index closed at 1,530.23, setting its first all-time closing high in more than 7 years. The index achieved a new all-time intraday high on October 11, 2007 at 1,576.09.

Between the bankruptcy of Lehman Brothers on September 15, 2008, and the end of 2008, the index closed either up or down 3% in one day 29 times. On October 13, 2008, the index closed up 11.6%, its best single-day percentage gain since being founded in 1957.

On November 20, 2008, the index closed at 752.44, its lowest since early 1997.

The index ended 2008 at 903.25, a yearly loss of 38.5%. The index continued to decline in early 2009, closing at 676.53 on March 9, 2009, its lowest close in 13 years. The drawdown from the high in October 2007 to the low in March 2009 was 56.8%, the largest since World War II.

At the trough of the United States bear market of 2007–2009, on March 6, 2009, the index was at 666. By March 23, 2009, the index had risen 20% from its low, closing at 822.92.

The index closed 2009 at 1,115.10, the second-best year of the decade.

On April 14, 2010, the index closed at 1,210.65, its first close above 1,200 since the financial crisis of 2007-2008. By July 2, 2010, it had fallen to 1,022.58, its lowest point of the year.

On April 29, 2011, the index closed at a post-crisis high of 1,363.61. However, after the August 2011 stock markets fall, on October 4, 2011, the index briefly broke below 1,100.

The index rose 13% in 2012 despite significant volatility amid electoral and fiscal uncertainty and round 3 of quantitative easing. On December 31, 2012, the index closed at 1,426.19, an annual gain of 13% and its biggest gain in 3 years.

On March 28, 2013, the index surpassed its closing high of 1,565.15, recovering all its losses from the Great Recession. On April 10, 2013, it closed above the intraday high from 2007.

On August 26, 2014, the index closed above 2,000 for the first time.

On March 2, 2015, the index reached an all-time closing high, while the Nasdaq Composite closed above 5,000 for the first time since 2000.

After the 2015–2016 Chinese stock market turbulence, a period of over a year with no new record highs ended on July 11, 2016, with the index closing at 2,137.16.

In June 2017, the index posted the largest weekly rise since the 2016 United States presidential election.

For the full year 2017, the index was up 19.4%, its best year since 2013. On September 25, 2017, the index closed above 2,500 for the first time.

The index rose sharply in January 2018, extending one of its longest monthly winning streaks, only to fall 4% in February 2018 during a month of extremely high volatility, including a day in which the VIX doubled. It was the first monthly decline in 11 months. In the third quarter of 2018, the index posted its best quarter since 2013. However, the index fell 11% in the month of December 2018, its worst December performance since the Great Depression. The index fell 6% in 2018, its worst year in a decade.

However, in 2019, the index posted its best first half in 22 years including the best June since 1938. On July 10, 2019, the index reached 3,000 for the first time. The index rose 31.5% in 2019, one of its best years.

On February 19, 2020, the index hit a new closing peak of 3,386.15, only to fall 10% in the next 6 trading days, its fastest drop from a new peak. By the 2020 stock market crash low on March 23, 2020, the index had fallen 34% from its peak. The index fell 20% during the first quarter of 2020, its worst quarter since 2008. This was followed by a 20% gain in the second quarter, its biggest quarterly gain since 1998. It had quickly recovered from its COVID-19 crash over a 6 month span and hit a new record on August 18, 2020.

Returns by year

NASDAQ

The Nasdaq is an American stock exchange located at One Liberty Plaza in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind only the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

History

1971–2000

Nasdaq" was initially an acronym for the National Association of Securities Dealers Automated Quotations.

It was founded in 1971 by the National Association of Securities Dealers (NASD), now known as the Financial Industry Regulatory Authority (FINRA).

On February 8, 1971, the Nasdaq stock market began operations as the world's first electronic stock market. At first, it was merely a "quotation system" and did not provide a way to perform electronic trades. The Nasdaq Stock Market helped lower the bid–ask spread (the difference between the bid price and the ask price of the stock), but was unpopular among brokers as it reduced their profits.

The NASDAQ Stock Market eventually assumed the majority of major trades that had been executed by the over-the-counter (OTC) system of trading, but there are still many securities traded in this fashion. As late as 1987, the Nasdaq exchange was still commonly referred to as "OTC" in media reports and also in the monthly Stock Guides (stock guides and procedures) issued by Standard & Poor's Corporation.

Over the years, the Nasdaq Stock Market became more of a stock market by adding trade and volume reporting and automated trading systems.

In 1981, Nasdaq traded 37% of the U.S. securities markets' total of 21 billion shares. By 1991, Nasdaq's share had grown to 46%.

In 1998, it was the first stock market in the United States to trade online, using the slogan "the stock market for the next hundred years". The Nasdaq Stock Market attracted many companies during the dot-com bubble.

Its main index is the NASDAQ Composite, which has been published since its inception. The QQQ exchange-traded fund tracks the large-cap NASDAQ-100 index, which was introduced in 1985 alongside the NASDAQ Financial-100 Index, which tracks the largest 100 companies in terms of market capitalization.

In 1992, the Nasdaq Stock Market joined with the London Stock Exchange to form the first intercontinental linkage of capital markets.

In 2000, the National Association of Securities Dealers spun off the Nasdaq Stock Market to form a public company.

2000–present

On March 10, 2000, the NASDAQ Composite stock market index peaked at 5,132.52, but fell to 3,227 by April 17, and, in the following 30 months, fell 78% from its peak.

In a series of sales in 2000 and 2001, FINRA sold its stake in the Nasdaq.

On July 2, 2002, Nasdaq Inc. became a public company via an initial public offering.

In 2006, the status of the Nasdaq Stock Market was changed from a stock market to a licensed national securities exchange.

In 2010, Nasdaq merged with OMX, a leading exchange operator in the Nordic countries, expanded its global footprint, and changed its name to the NASDAQ OMX Group.

To qualify for listing on the exchange, a company must be registered with the United States Securities and Exchange Commission (SEC), must have at least three market makers (financial firms that act as brokers or dealers for specific securities) and must meet minimum requirements for assets, capital, public shares, and shareholders.

In February 2011, in the wake of an announced merger of NYSE Euronext with Deutsche Börse, speculation developed that NASDAQ OMX and Intercontinental Exchange (ICE) could mount a counter-bid of their own for NYSE. NASDAQ OMX could be looking to acquire the American exchange's cash equities business, ICE the derivatives business. At the time, "NYSE Euronext's market value was $9.75 billion. Nasdaq was valued at $5.78 billion, while ICE was valued at $9.45 billion."[1 Late in the month, Nasdaq was reported to be considering asking either ICE or the Chicago Mercantile Exchange to join in what would probably have to be, if it proceeded, an $11–12 billion counterbid.

In December 2005, NASDAQ acquired Instinet for $1.9 billion, retaining the Inet ECN and subsequently selling the agency brokerage business to Silver Lake Partners and Instinet management.

The European Association of Securities Dealers Automatic Quotation System (EASDAQ) was founded as a European equivalent to the Nasdaq Stock Market. It was purchased by NASDAQ in 2001 and became NASDAQ Europe. In 2003, operations were shut down as a result of the burst of the dot-com bubble. In 2007, NASDAQ Europe was revived first as Equiduct, and later that year, it was acquired by Börse Berlin.

On June 18, 2012, Nasdaq OMX became a founding member of the United Nations Sustainable Stock Exchanges Initiative on the eve of the United Nations Conference on Sustainable Development (Rio+20).

In November 2016, chief operating officer Adena Friedman was promoted to chief executive officer, becoming the first woman to run a major exchange in the U.S.

In 2016, Nasdaq earned $272 million in listings-related revenues.

In October 2018, the SEC ruled that the New York Stock Exchange and Nasdaq did not justify the continued price increases when selling market data.

The U.S. stock market and economic recession over the past 50 years

1970S: The 1970s marked a period of economic uncertainty and troubled relations between the United States and certain Middle Eastern countries. The energy crisis of the 1970s was a prelude to a catastrophic economic climate, stagflation, high unemployment and high inflation. However, in a short relief in the long bear market, on November 14, 1972, the average closing price exceeded 1,000 points for the first time, closing at 1,003.16. Between January 1973 and December 1974, the average lost 48% of its value in the 1973-1974 stock market crash, and closed at 577.60 on December 4, 1974. In 1976, the index was repeated several times. To reach 1,000, 1,004.75 at the end of the year. Although the Vietnam War ended in 1975, the 1979 Iranian Revolution created new tensions around Iran. From a performance perspective, the index actually remained unchanged in the 1970s, rising from a level of around 800 to 838, an increase of less than 5%.

1980S The NBER considers a very short recession to have occurred in 1980, followed by a short period of growth and then a deep recession. Unemployment remained relatively elevated in between recessions. The recession began as the Federal Reserve, under Paul Volcker, raised interest rates dramatically to fight the inflation of the 1970s. The early 1980s are sometimes referred to as a "double-dip" or "W-shaped" recession.

The Iranian Revolution sharply increased the price of oil around the world in 1979, causing the 1979 energy crisis. This was caused by the new regime in power in Iran, which exported oil at inconsistent intervals and at a lower volume, forcing prices up. Tight monetary policy in the United States to control inflation led to another recession. The changes were made largely because of inflation carried over from the previous decade because of the 1973 oil crisis and the 1979 energy crisis.

Early 1990S Recession

After the lengthy peacetime expansion of the 1980s, inflation began to increase and the Federal Reserve responded by raising interest rates from 1986 to 1989. This weakened but did not stop growth, but some combination of the subsequent 1990 oil price shock, the debt accumulation of the 1980s, and growing consumer pessimism combined with the weakened economy to produce a brief recession.

Early 2000S Recession

The 1990s were the longest period of economic growth in American history up to that point. The collapse of the speculative dot-com bubble, a fall in business outlays and investments, and the September 11th attacks, brought the decade of growth to an end. Despite these major shocks, the recession was brief and shallow.

Great Recession

The subprime mortgage crisis led to the collapse of the United States housing bubble. Falling housing-related assets contributed to a global financial crisis, even as oil and food prices soared. The crisis led to the failure or collapse of many of the United States' largest financial institutions: Bear Stearns, Fannie Mae, Freddie Mac, Lehman Brothers, and AIG, as well as a crisis in the automobile industry. The government responded with an unprecedented $700 billion bank bailout and $787 billion fiscal stimulus package. The National Bureau of Economic Research declared the end of this recession over a year after the end date. The Dow Jones Industrial Average (Dow) finally reached its lowest point on March 9, 2009.

Covid-19 Recession

The first documented case of COVID-19 emerged in Wuhan, China in November 2019. The government in China first instituted travel restrictions, quarantines and stay-at-home orders. When efforts to contain the virus in China were unsuccessful, other countries instituted similar measures in an attempt to contain and slow the spread of the virus, which prompted many cities to close. The initial outbreak expanded into a global pandemic. The economic effects of the pandemic were severe. More than 24 million people lost jobs in the United States in just three weeks. Official economic impact of the virus is still being determined but the stock market responded negatively to the shock to supply chains, primarily in technology industries.

Conclusion

1) As the world's largest financial market, the United States gathers the world's top 500 listed companies. About 40% of the world's funds are in the United States. On the one hand, the continuous growth of these companies drives the rise of the stock market. On the other hand, commodities are denominated in U.S. dollars, which has increased the demand for U.S. dollars worldwide. These funds have also entered the stock market, creating a century-old bull market in U.S. stocks.

2) There will be cyclical bear markets during the long-term bull market in the U.S. stock market, and the appearance of a bear market usually has an harbinger. This has been verified by the two recent financial market crashes. The US financial tsunami occurred in September 2008 when Lehman Brothers went bankrupt. However, in July 2007, some small and medium-sized banks had already experienced a wave of bankruptcy, including New Century Bank. In January 2008, all major American banks suffered huge losses, of which Citibank lost 10 billion in the fourth quarter. In March 2008, Bear Stearns, one of the five largest investment banks, declared bankruptcy. Judging from the recent economic recession caused by the Covid-19 pneumonia, the Covid-19 pneumonia first appeared in Wuhan, China. Although the Chinese government has adopted strong measures, it has not prevented the virus from spreading to the world.

3) The recovery of the stock market also follows a certain pattern. There is always a process from economic recession to economic recovery. 1.The recovery of the stock market usually requires three conditions to ensure that the economy will recover in the next 3-6 months. The stock market usually represents the future trend of the economy, and it usually has an early effect. 2. The Fed's interest rate must be near zero. During the economic recession, business operations have encountered great difficulties, so reducing borrowing costs is very important for a company, which can make the company's capital turnover and help the company tide over the difficulties. 3. The Federal Reserve repurchases bonds to help companies in difficulty extend loans. In an economic recession, banks usually do not intend to lend funds to risky companies in order to protect themselves. This will lead to a credit crisis and ultimately bankrupt the companies. In this case, the Fed actually acts as a bank.

US dollar trend analysis

Unlike the rising trend of the US stock market for decades, the trend of the US dollar index will not always go upwards. It is a downward trend with a cyclical upward line. Mainly because the strength of the US dollar has its own advantages and disadvantages to the US economy.

From 1978 to 1985, the U.S. dollar rose from a low of 85 to a high of 126. During this period of time, the international situation has changed. The Soviet Union invaded Afghanistan at the end of 1979, which led to increasing tensions between the Soviet Union and Western countries and Middle Eastern countries. After Reagan was elected President of the United States on behalf of the Republican Party in 1980, the United States and other Western countries tried to prevent Threats from the Soviet Union have formulated the "Star Wars" plan and deployed missile defense systems in European countries, which enabled the rapid development of US military enterprises. On the other hand, oil production in the United States has soared, and the oil industry has developed rapidly. The United States GDP increased and the dollar index rose sharply.

From 1992 to 2000, the U.S. dollar rose from the lowest point of 85 to the highest point of 113. During this period, the world continued two large-scale financial crises, one was the South American financial crisis in the early 1990s, and the other was Asia at the end of the 1990s. Financial turmoil. At this time, the Internet technology in the United States was rapidly developed, and a large amount of funds returned to the United States, which improved the status of the US dollar. From 2000 to 2010, the dollar fell from the highest point of 113 to the lowest point of 80. The fall of the dollar was due to the bursting of the Internet bubble and the terrorist attacks of 9/11 in the United States, which involved the United States in the long-term Middle East war. In addition, Bush G. banned the use of oil at the time. US oil production was only 5 million barrels per day in 2005, and oil prices reached a record high of $147 per barrel in 2008. Later, the dollar rose because of the substantial increase in US oil production from 4 million barrels per day in 2008 to 13 million barrels per day now.

Strong US dollar

-

A strong US dollar will result in falling oil prices. The fall in oil prices has caused the entire energy price to fall, leading to a fall in prices, which will make American consumers have more consumer spending.

-

Due to the fall in energy prices, a strong US dollar is conducive to the development of industries in the United States other than energy companies.

-

A strong U.S. dollar will help the U.S. to import more foreign goods and is positive to U.S. companies overseas.

-

A strong US dollar makes it easier for American tourists to travel abroad for consumption, which will be good for the economic of other countries.

Weak US dollar

-

Good for American university education. The devaluation of the U.S. dollar against the currencies of other countries will make it easier for students from other countries to come to the United States to go to school, and it will also attract better talents from all over the world to study, settle, work and start businesses in the United States.

-

A weak US dollar makes manufacturing in the United States cheaper, which is lead to the return of manufacturing to the United States.

-

The weak US dollar makes it easier for foreign tourists to travel to the United States, which is conducive to the development of the United States' tourism, catering, retail, and hotel industries, which will help increase American production and employment.

A strong dollar and a weak dollar each have positive and negative effects. A strong U.S. dollar helps American consumers because it makes foreign goods (which American consumers obviously like to buy) cheaper. However, this hurts U.S. exports and thus U.S. production and employment. This also makes the United States a travel destination that foreign tourists cannot afford.

A weak US dollar is conducive to rising oil prices. Because a weak US dollar reduces the cost of goods produced in the United States, it is conducive to the return of overseas factories to the United States, which is conducive to exports and is conducive to reducing the trade deficit.

Therefore, the best "dollar policy" is to balance the pros and cons of the strong and weak US dollars and take into account the economic policies of our trading partners. The last point is important: for example, a strong dollar against the euro will weaken the euro. EU products will become more affordable for Americans, and Americans will be encouraged to travel to Europe. This can help EU countries in recession and unemployment.

Indeed, many Europe and Asia correctly view the United States as the engine of global economic growth. The US market is so large, strong, driven by consumption, and partially dependent on imports, so it can boost production in European and Asian countries. This is a huge responsibility, and Americans are unwittingly willing to take on this responsibility by virtue of their free consumption. Similarly, when the US business cycle declines and demand decreases, no one in Europe or Asia is happy about it. Of course, the economic policies and behaviors of Europe and Asia are the greater determinants of their economic fate. So it’s too much to say "When America sneezes, Europe will feel cold", but there is a truth in it.

U.S. non-farm employment data

The U.S. non-farm employment data is published monthly, mainly introducing the number of U.S. employment, salary increase or decrease, unemployment rate, and weekly working hours. Non-agricultural data is an important reference indicator for the Fed's decision to raise or cut interest rates. Increase in employment or wage growth means that the US economy is strong, which will boost the dollar, and vice versa.

Two parties in power

It is generally believed that the Democratic Party is in favor of a strong dollar. A strong U.S. dollar is conducive to the development of high-tech industries in the United States, and a strong U.S. dollar is conducive to the decline in corporate costs and increased profits of American multinational corporations overseas. However, a strong dollar is not conducive to export companies, and is not conducive to the development of the oil industry and military industry companies. The ruling Republican dollar will be relatively weak. The Republican Party represents more the interests of the energy industry and military industry enterprises.

U.S. interest rate policy

The Federal Reserve has 8 meetings a year to decide whether to raise interest rates, cut interest rates or keep interest rates unchanged according to the economic situation in the United States.The 2020 meeting dates are: January 28, March 17, April 28, June 9, July 28, September 15, November 4, and December 14 for settlement. The Fed usually makes a decision based on two data. The first is the employment figures in the United States and the second is the inflation in the United States. If the unemployment rate is less than 5%, it is considered full employment, which will increase the possibility of raising interest rates. Similarly, if inflation is higher than 2%, it will increase the possibility of interest rate hikes. It is generally believed that if interest rates are raised when inflation is low, the dollar index will rise. In the case of high inflation, the dollar index will not rise.

War

In the 1970s, the United States was involved in the Vietnam War, and wars between Israel and Arab countries also broke out in the Middle East. The U.S. dollar fell sharply, gold and oil rose sharply, and global inflation soared. It was not until September 1978 that the United States withdrew its troops from Vietnam and the Middle East war came to an end, and the dollar began to rise. Also in 2001, due to the 9/11 terrorist attack in the United States, the United States was involved in the wars in Afghanistan and Iraq, and the dollar also fell rapidly.

It must be pointed out that if Russia is involved in the war, the situation may be the opposite. For example, the Soviet Union's invasion of Afghanistan in December 1979 caused the United States and Saudi Arabia to jointly increase oil production. By the mid-1980s, oil prices plummeted and the dollar index skyrocketed. Also in 2014, the Ukraine crisis broke out. Crimea voted to join Russia. Russia sent volunteers to fight against Ukrainian government forces in eastern Ukraine. The dollar index soared by 17 percentage points from July 2014 to January 2016.